Role of AI in FinTech Fraud Prevention and Compliance Monitoring

Introduction

The Financial Technology (FinTech) sector is thriving rapidly in this data-driven, digital age. However, this growth causes a rise in online fraud and compliance-related issues. This is a major reason why FinTech companies consider cybersecurity as their primary concern. Thanks to advancing technology, we can leverage AI in FinTech to address this concern.

Artificial Intelligence (AI) emerges as a game-changer in preventing fraud and monitoring compliance in real-time. AI can detect unusual patterns and predict potential risks in advance by combining speed, adaptability, and accuracy. This post digs deep into the role of AI in FinTech fraud detection and compliance monitoring.

How about going through the prevalent challenges related to compliance and fraud in the thriving FinTech industry?

Challenges of Compliance and Fraud in FinTech Sector

Evolving technology increases comfort and convenience for customers in the BFSI sector. Fraudsters, however, may spoil the party by performing malicious activities or sham transactions. As per Alloy’s 2024 report, over 50 percent participants reported increase in business fraud and over 75 percent of them reported an increase in consumer fraud.

Shockingly, highly sophisticated fraud attempts have become more prevalent these days and it is expected that advances to Gen AI will cost banks an estimated USD 40 billion loss as fraud by 2027. In such a challenging scenario, AI technology can lend a helping hand to prevent fraud and address related issues in the FinTech industry.

This is not all. The FinTech industry is highly regulated and needs to follow strict legal and national standards. Multi-layered regulations are applicable on every process of the FinTech sector ranging from customer onboarding to transaction. Non-compliance or failure in meeting regulations results in fines and other financial risk.

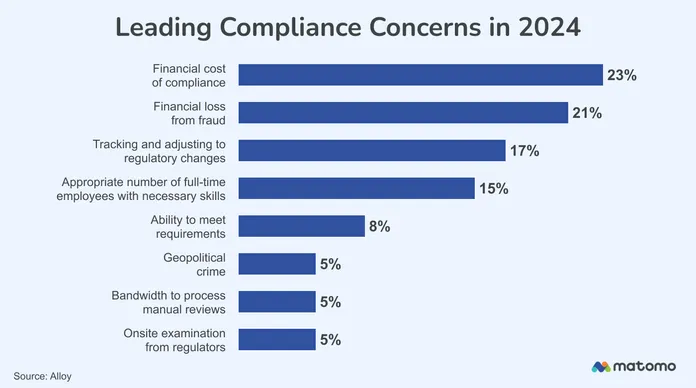

Let’s face it. A recent Alloy survey reveals that as many as 93 percent of FinTech companies find it difficult to meet compliance regulations. The following graph shows the major compliance concerns for FinTech companies. As per this graph, the financial cost of meeting compliance tops the chart with 23 percent.

Source

Financial loss due to fraud is another major concern with 21 percent in the list. AI in fintech can address these challenges effectively for the FinTech sector. Let’s understand the role of AI in monitoring compliance and detecting fraudulent transactions in financial industry.

AI Compliance Monitoring for FinTech Industry

AI in fintech software solutions ensures that all financial transactions and processes follow regulatory requirements and internal policies. AI scans a huge amount of transactional and operational data to identify potential compliance breaches in real time. AI solutions can monitor, analyze, and detect anomalies automatically.

Moreover, ML and NLP technologies are useful for analyzing unstructured data and learning from it to predict potential risks. Together with AI, these technologies streamline the process, generate reports, and update compliance-related information without manual assistance. This makes the entire monitoring process more accurate.

It is better to consult a reputable AI software development company to know the scope of AI in compliance monitoring for your financial firm.

How to Detect Fraud with AI in Real Time

Artificial intelligence technology is useful for continuous monitoring and instant decision-making through advanced algorithms. Altogether, AI acts as a reliable FinTech fraud detection tool. Let’s dig in.

AI, together with machine learning, can detect any unusual location and amount for a purchase. It also analyzes how a user interacts with a device, especially in the case of mobile apps. A sudden or abrupt shift in these patterns may indicate fraudulent activity.

Natural language processing (NLP) can analyze customer communications or chat interactions to detect fraudulent intent in real time. It is useful for claims processing or AI fraud prevention. Moreover, AI can assign a real-time fraud risk score to every transaction. This score facilitates FinTech companies to flag high-risk activities for manual reviews.

Benefits of AI in FinTech for Compliance and Fraud Detection

AI in FinTech can be a game-changer. It gives the following benefits in the sector related to compliance and fraud detection--

Real-Time Monitoring and Alerts

AI scans transactions and activities in real time. It flags suspicious behavior or compliance breaches instantly, thereby reducing the time between detection and response.

Proactive Risk Management

This is one of the big benefits of AI in FinTech software solutions. This technology offers predictive analytics functionality to forecast potential risks related to fraudulent activities.

More Scalability for Massive Data

AI can manage thousands of transactions and complex datasets effectively. FinTech companies can manage their global operations seamlessly with the help of this technology.

Effective Reporting and Auditing

AI-based systems generate audit-ready reports quickly to ensure data accuracy while maintaining detailed logs. Furthermore, these systems simplify the complexities of audits and regulation management.

Cost and Resource Efficiency

AI can automate compliance tracking and fraud monitoring. It reduces the requirement for making human efforts significantly. As a result, your team can focus on strategic decisions by handling various repetitive tasks related to compliance.

A robust and reliable FinTech software development company can assist your institution to leverage these benefits. It is interesting to see the future trends of AI in the FinTech sector.

Future Trends of AI in FinTech Security

The future of AI in FinTech security will include predictive and autonomous protection systems. Advanced predictive analytics use massive datasets that have historical details and information on market behaviours. Deep learning models will adapt to emerging threats instantly to eliminate the requirement of human intervention. Apart from these trends, we can expect the prevalence of combination of AI with blockchain technology to make transaction records transparent and tamper-proof. It will make it difficult for fraudsters to steal or alter data. We will witness the rise of generative AI and advanced behavioral analysis. It will be useful for detecting subtle fraud signals.

Finally, AI fraud prevention will make RegTech (Regulatory Technology) more sophisticated and prevalent. AI will automate compliance audits and rensure instant adherence across different jurisdictions to strengthen RegTech over the period. FinTech companies will maintain a subtle balance between innovation and user experience with the use of AI.

Role of Silicon IT Hub in Developing FinTech Software Solutions

We offer top-notch AI & ML development services to drive tangible business outcomes. Our in-house team of experienced AI developers assist companies to drive growth with automation and digital transformation. We address complex business objectives of FinTech using the advancements of AI, ML, and other emerging technologies.

Our extensive research and a holistic approach can assist FinTech companies to get robust solutions for data forecasting and data analysis. We also build high-end FinTech software solutions that have cutting-edge features based on recommendation engine, natural language processing, and predictive analytics.

Let’s connect to discuss the scope of AI for your FinTech organization.

LET’S CONNECTConcluding Remarks

Integration of AI in FinTech solutions offer many business benefits including more scalability and higher cost efficiency through automation. However, one of the biggest roles AI plays in the FinTech sector is in managing compliance and detecting fraudulent activities.

We can expect the convergence of Blockchain, Generative AI, and other emerging technologies in the futuristic FinTech software solutions.

Have an Idea?Let’s Build It Together!

Have an Idea?Let’s Build It Together!